Report Security Incidents to AFCU

Should you detect any suspicious activity on your account, please report it to the Credit Union immediately. You can email us at infosecurity@aerofcu.org or call 800-795-2325.

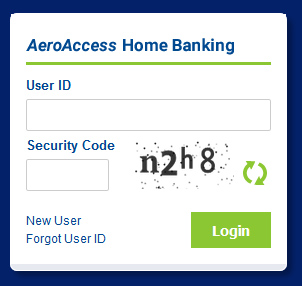

Online Home Banking Security

AeroAccess Home Banking includes a Security Code CAPTCHA (Completely Automated Public Turing test to tell Computers and Humans Apart) at Login for security purposes.

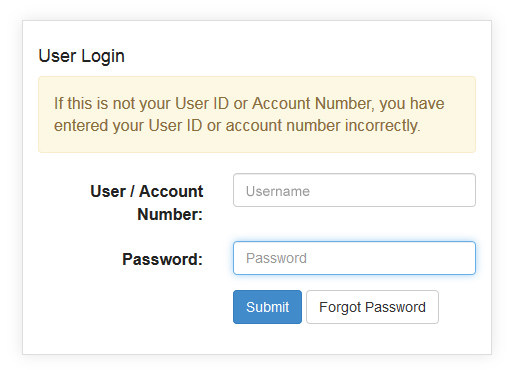

Once you have entered the CAPTCHA to Login to AeroAccess, you must then enter your Password for another level of security.

Here are some ways that you can help to safeguard your accounts from unauthorized access:

- Create unique passwords for each account that you use online. Make sure to change your passwords periodically to minimize the risk that compromised credentials might lead to unauthorized access to your account. Consider the use of personal password safe software, which can make the creation, use and storage of your passwords easier to manage.

- Monitor your AFCU account regularly to check for unauthorized activity. Use the AeroAccess online home and mobile banking tools to view your account history often. In addition, whether you choose to receive your account statements electronically or by mail, be sure to check your monthly statements for accuracy.

- Use the Alerts feature in AeroAccess Home Banking (Services -> Alerts) to receive notification of high-risk events, such as email or address changes, high dollar transfers, etc.

- Utilize the Security Code feature of AeroAccess Home Banking (User Options -> Change Security Log On Options) to send a one-time password to your cell phone or email address when logging into the system.

- Establish an account password for in-person and telephone-initiated account access. An AFCU member service representative will ask you to verify the password before performing any transactions or maintenance on your account.

Mobile Banking Security

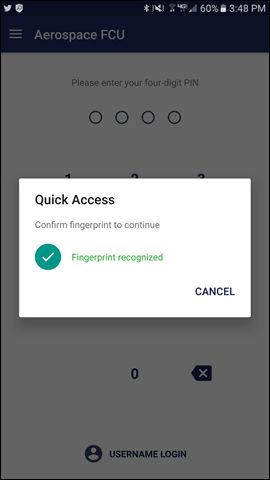

Quick Access is a feature in the AeroAccess Mobile App that allows you to log into AeroAccess Mobile Banking using Touch ID or a four-digit PIN. This allows for a quick and convenient way to access your account without compromising security.

EMV Chip Technology

EMV technology uses a microchip on your credit card to encrypt your financial information. It’s just a more secure version of the magnetic strip that’s on the back of your credit card now. EMV derives its name from the three major companies who are behind the protocol development: Europay, Mastercard, and Visa. It’s verified at a point of sale terminal, just like a normal credit card. The more advanced technology makes it possible to have a much stronger form of encryption, which makes your data more secure.

The cost of implementation has always held EMV technology back, because that cost was greater than the amount of fraud loss it would prevent. Now, with data theft affecting more and more retailers’ profits, the calculations are changing. Regulatory changes have made retailers liable for more fraud damages, and that makes EMV technology more cost-effective. Most retailers have committed to implementing EMV technology.